Insights | By Howard Tiersky

Streaming Takes Over the Media Industry

Recently, we’ve been taking a look back at digital trends in different industries from the last year, and comparing them to previous years.

In this edition, I want to look at the media industry, and see how the current trends have shaped the customer landscape. The media industry in particular is one that has certainly been affected by digital transformation, as well as by the pandemic.

Customer preferences, behaviors and habits have changed drastically since the start of the pandemic, and media is one space where that’s very apparent.

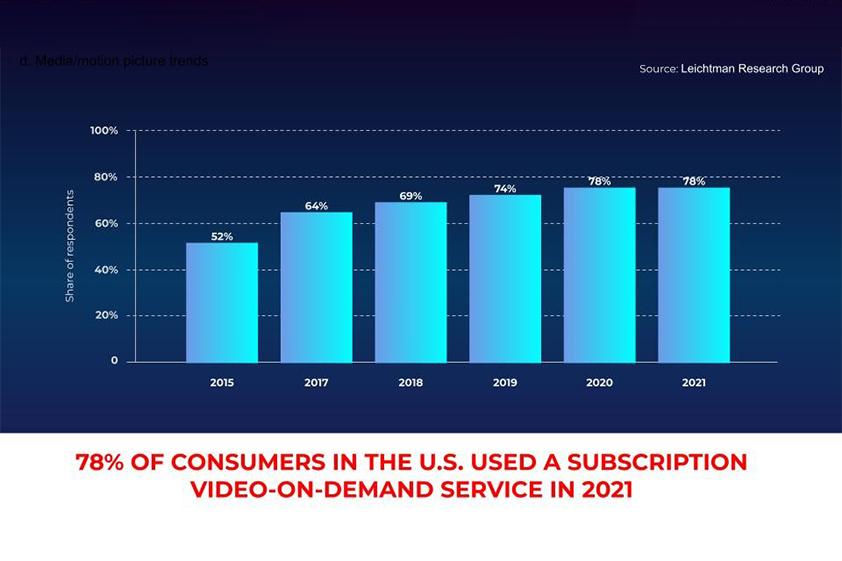

THE MAJORITY OF US CONSUMERS SUBSCRIBE TO AT LEAST ONE STREAMING SERVICE

By the end of 2021, 78% of Americans were using at least one video-on-demand subscription service. This does not include traditional cable or satellite television—this is specifically streaming platforms like Netflix, Hulu, Peacock, HBOMax, Disney+, and the like.

78% is near ubiquitous adoption of digital streaming, and that’s a massive change from the numbers just a few years earlier. In 2015, only 52% of Americans subscribed to a streaming service.

The growth really reached a peak in 2020 when the pandemic began, and then flattened out in 2021. Perhaps this flattening was due to the pandemic itself, or maybe streaming is reaching a saturation point.

There will always be a segment of people who simply don’t have the means, discretionary income, or internet connection to subscribe to streaming services, so there may not be much more room for growth in the US for streaming beyond the 78% that it’s at now.

THE AVERAGE AMERICAN SUBSCRIBES TO 8 VIDEO-ON-DEMAND PLATFORMS

Insider Intelligence did a study that shows how many video-on-demand subscription services each person has on average, from 2016 and all the way through 2021. It’s important to note that this study does include both free (ad supported) and paid subscription services.

In 2016, the average number of subscriptions per person was 4.0. There was growth each subsequent year until in 2020, when the average flattened and was the same as it was in 2019, at 6.9 subscriptions per user.

Then in 2021, the average increased again to 8.8 subscriptions per user. A possible explanation for this is that in 2021, we saw individual streaming platforms begin to launch more and more high quality original content that can only be viewed on their platform.

For example, Amazon Prime Video has been producing many original shows that are exclusive to Prime Video. Other platforms like HBOMax, Peacock, Hulu, Disney+ and more are also doing the same.

So if consumers want to watch multiple different original shows, chances are they will need to hold more subscriptions to be able to view them all.

WHILE AVERAGE SUBSCRIPTIONS ARE UP, STREAMING REVENUE PLATEAUS

The graph below from Insider Intelligence shows that although more Americans have multiple streaming subscriptions, revenue has not increased much. From 2020 to 2021, there was only a 3.6% increase in revenue from these video-on-demand platforms.

This may be because some streaming services are using a model where they have a basic free version customers can subscribe to, and then have the option to upgrade to the premium version later. NBC’s Peacock is an example of this. They have a free subscription, as well as two levels of paid subscriptions (one with ads, and one without).

Another possible explanation is that these streaming services aren’t necessarily making a lot of profit right now in general. Netflix is increasing their monthly subscription prices to help cover the cost of all the original content they’re producing, and they aren’t the only company in that boat.

While this is hurting profit margins substantially, this is no doubt a growth play for the future. Each of the platforms that are investing in creating really high quality original content are looking to become dominant in the streaming space, and win out over the competition.

USERS ARE SPENDING MORE TIME CONSUMING CONTENT ON STREAMING SERVICES

To further support the importance of these subscription video-on-demand services, the graph below shows the increase in the average minutes per day consumers are spending on these streaming platforms.

The most substantial increase we have seen is from 2019 to 2020. In 2019, the average consumer was spending 51 minutes per day on streaming platforms, and in 2020, we saw that number increased to 62 minutes per day.

This is no surprise considering the pandemic kept many people home, and gave individuals more time to consume this type of content.

In 2021, the growth continued and the average minutes per day spent on streaming services increased yet again to 67 minutes.

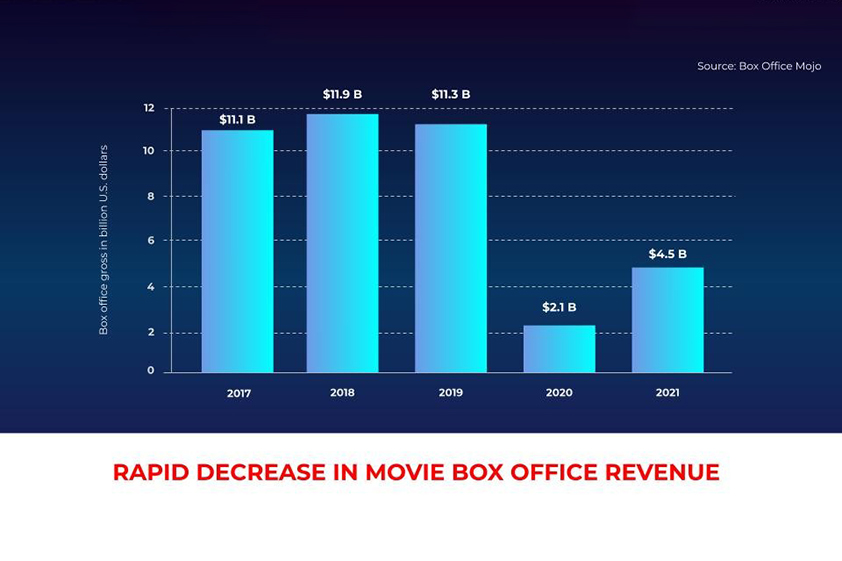

BOX OFFICE REVENUE PLUMMETED WHEN THE PANDEMIC STARTED AND HAS NOT RECOVERED

The area of the media industry that has been hit the hardest in the last few years by far is movie theaters.

In many parts of the country, movie theaters remained closed for a year or more. Box office revenues were completely decimated by COVID, and even as the threat of the pandemic wanes as vaccination rates increase, movie theaters have not yet made much of a comeback.

In the chart below, you can see that box office revenue was already on the decline in 2019, and in 2020, it decreased dramatically. Even though the 2021 revenue was roughly double what it was in 2020, it’s still so much less than it was pre-pandemic.

One thing that filmmakers began doing during the pandemic was releasing their brand new movies (that would traditionally only be shown in theaters before being released digitally), exclusively on streaming services. This gave consumers the opportunity to view new releases from the comfort and safety of their own homes.

This not only contributed to the increase in streaming subscriptions overall, but it continues to contribute to the decrease in movie box office revenue.

THE SHIFT FROM THEATERS TO STREAMING IS HERE TO STAY

The pandemic has no doubt changed consumers’ preferences when it comes to consuming video content. It’s obvious that during the beginning of the pandemic, people simply did not have the option to go to the movie theater—but even now that the theaters are open, consumers still seem to prefer streaming.

In the chart below, we can see data from a survey conducted over a few years by The Morning Consult. In November of 2018, when asked about their preference between going to the movie theater versus streaming a movie, 28% of participants said they strongly preferred the theater. And 25% said they somewhat prefer the theater. At that point in time, only 15% preferred streaming.

By March 2020, when participants were asked the same question, we saw a massive shift in their answers. By then, 27% of respondents said they strongly prefer streaming a movie, and only 18% said they prefer the theater.

If you fast forward even further to June of 2020, the numbers are swaying more towards streaming, and the survey shows that 36% of participants strongly prefer streaming, and only 14% prefer the theater.

IN SUMMARY

Streaming is here to stay, and more and more consumers will “cut the cord” with their cable company in the coming months and years.

I predict that there will be more aggregation between streaming services, as consumers will have to make choices between different platforms to subscribe to. Hulu and Disney have already begun to do this, by offering a bundle that allows subscribers to have access to both Hulu and Disney+. I think other streaming platforms will follow suit within the next year or so.

And while theaters were already on the decline before COVID, I think there’s only a small chance that physical theaters will return to the level where they once were. There’s just so many more convenient and affordable options for consumers to enjoy brand new digital content from their homes, to make the experience of the movie theater worth it.

My Wall Street Journal bestselling book, Winning Digital Customers: The Antidote to Irrelevance, contains a blueprint for developing a successful strategy for your company as well as practices to aid in identifying new trends and opportunities to explore. You can download the first chapter for free here or purchase the book here.